“An ounce of prevention is worth a pound of cure.” — Benjamin Franklin

Every year, thousands of NRIs travel to India to reconnect with family, celebrate milestones, and relive the comfort of home. Flights are booked months in advance, gifts are packed with care, and family schedules are planned down to the last detail. But there is one preparation most NRIs overlook — health coverage during their visit. And they usually realize its importance only when the unexpected happens.

When the Whole Family Comes Home

Manish Gupta, a Boston-based professional, had been looking forward to his India trip for months. This time, the journey was special — he was flying from New Jersey with his wife and children to spend two precious weeks with his parents. Back home, the excitement had already taken over the household. His mother was preparing his favorite meals, the kitchen filled with traditional dishes he had missed for years. His father was calling relatives and planning visits. For the grandparents, the greatest joy was simply having their grandchildren around after such a long gap.

Like most NRIs, Manish had planned everything carefully — flights booked early, gifts packed, school schedules adjusted, and even a short family getaway included. But there was one thing he did not plan at all. Health insurance. After all, this was India. Home.

When the Unexpected Happens

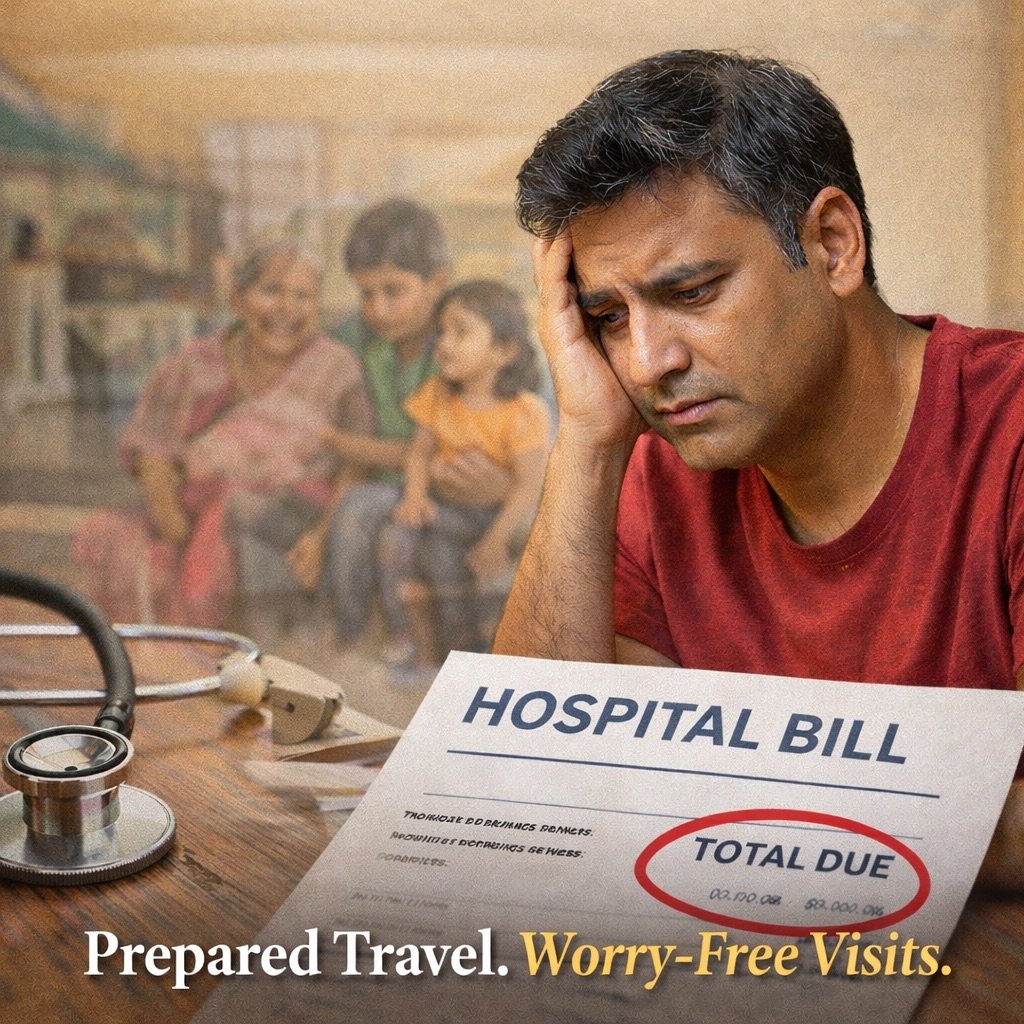

Four days into the visit, after a packed schedule of family gatherings, outside food, weather changes, and adjusting to the time difference, Manish began experiencing severe abdominal pain. By afternoon, the discomfort became intense enough for the family to rush him to a reputed private hospital. The experience was reassuring — the doctors were highly qualified, tests were conducted immediately, and he underwent an emergency procedure the same evening. Within two days, he was stable and recovering well. The care was efficient and world-class. But when it was time for discharge, the entire bill had to be paid out of pocket — and that was the moment reality sank in.

The NRI Blind Spot

On the drive back home, Manish couldn’t ignore the irony. Whenever his parents visit the United States, he always ensures they are fully insured. When relatives travel from India to Europe or other countries, travel insurance is considered essential. But when he himself travels to India, like most NRIs, he had never even thought about medical coverage. The reason is simple — India feels familiar, comfortable, and safe. But medical emergencies don’t recognize emotional comfort.

India’s Healthcare Reality Today

India today offers world-class healthcare with advanced technology, highly skilled specialists, and immediate access to treatment without long waiting periods. Many NRIs prefer private hospitals in India because of their quality and efficiency. However, quality care also comes at a cost. Even short hospital stays or routine procedures at leading private hospitals can result in significant unexpected expenses. For NRIs arriving after long international flights, adjusting to climate changes, different food habits, packed schedules, and physical fatigue, the risk of sudden health issues is higher than most people realize.

Recognizing this growing need, Indian insurers now offer health plans specifically designed for NRIs and OCI holders. These plans provide high coverage at significantly lower premiums compared to international policies — often with savings of 40–50% — and in many cases eliminate the need to purchase separate travel insurance or extend expensive overseas health plans during India visits. Health Insurance – NRI & OCI

The Value of Trusted Guidance

For many NRIs, the challenge is not the decision to get coverage but understanding which plan to choose, how claims work, and whether the policy will truly support them during short visits. This is where Ensuring Smiles IMF LLP has built a strong reputation. Focused exclusively on the needs of NRIs and OCI holders, the organization helps travelers identify the right coverage based on age, visit frequency, and health profile, understand hospital networks and claim procedures, and prepare in advance so their India visits remain worry-free.

Their approach is practical, personalized, and built around one simple idea — when you travel home, healthcare concerns should never become a burden.

As Mr. Dua, Founder of Ensuring Smiles IMF LLP, explains, “For NRIs, India is not just a destination — it is home. Our mission is to ensure that when they come home, healthcare worries never become part of their journey. The right protection brings peace of mind for the entire family.”

NRIs who want to explore suitable coverage options or seek guidance can visit www.ensuringsmiles.in, email support@ensuringsmiles.in, or call/WhatsApp +91 8397047681. Health Insurance – NRI & OCI

A New Addition to the India Travel Checklist

Manish recovered quickly and went on to enjoy the rest of the trip — family dinners, stories with his parents, and grandparents making memories with the grandchildren. But before returning to the United States, he made one important decision: he arranged health coverage for all future India visits.

Because he realized something simple — we insure our parents when they travel, we insure ourselves when we visit foreign countries, but when we go home, we rely only on hope.

The next time you plan your India trip, add one more quiet item to your checklist. Not because you expect something to go wrong, but because peace of mind allows you to focus on what truly matters — family, memories, and the joy of being home.